SATURDAY, APRIL 9, 2016

Now Here’s Some More Strategery That’s Long Overdue

This morning at the Conservative Agenda, with our Dreaded Tax Day quickly approaching, Political Insiders were discussing the Tax Plans of the surviving Republican Presidential Candidates.

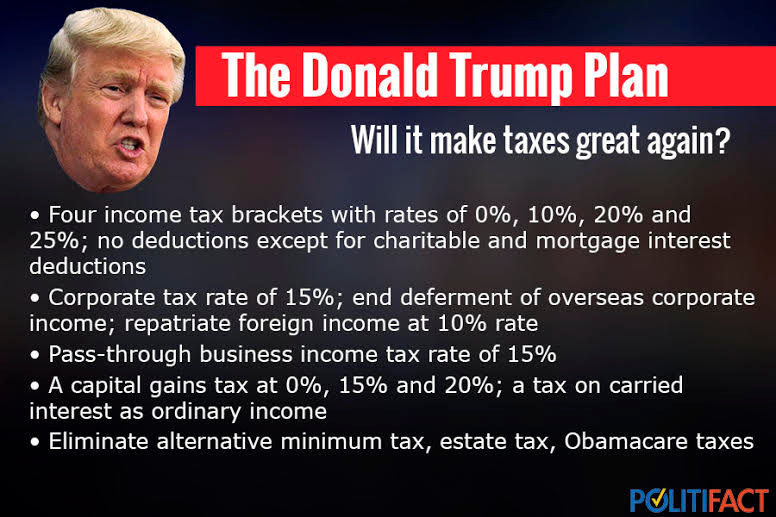

![]() Donald Trump’s Tax Plan would substantially lower individual income taxes and the corporate income tax and eliminate a number of complex features in the current tax code.

Donald Trump’s Tax Plan would substantially lower individual income taxes and the corporate income tax and eliminate a number of complex features in the current tax code.

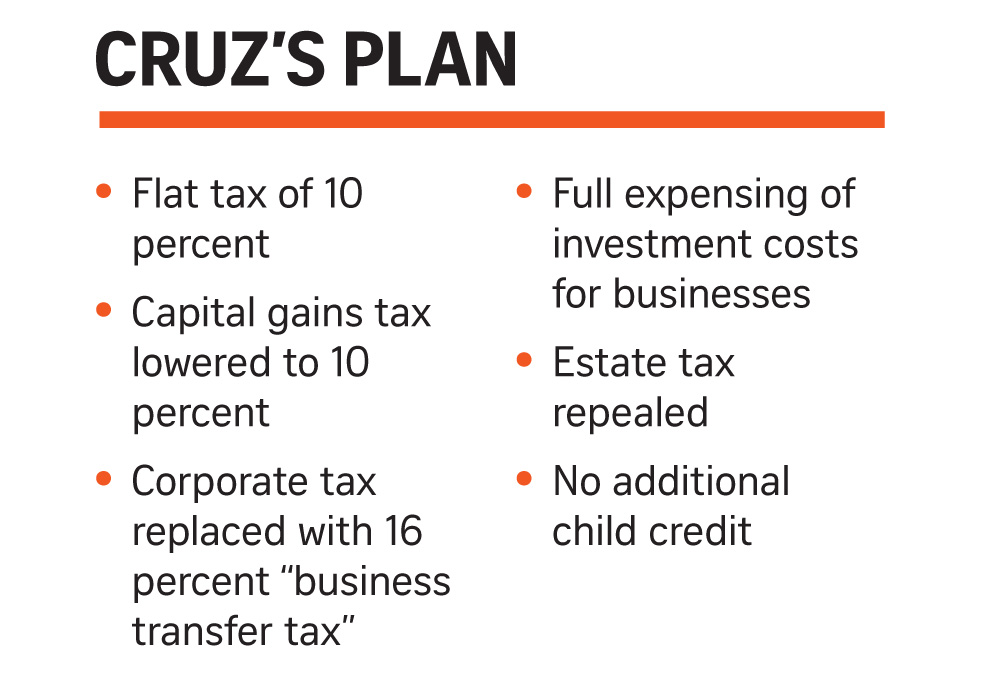

![]() Senator Cruz’s Tax Plan would enact a 10% flat tax on individual income and replace the corporate income tax and all payroll taxes with a 16% “Business Transfer Tax,” or subtraction method value-added tax. In addition, his plan would repeal a number of complex features of the current tax code.

Senator Cruz’s Tax Plan would enact a 10% flat tax on individual income and replace the corporate income tax and all payroll taxes with a 16% “Business Transfer Tax,” or subtraction method value-added tax. In addition, his plan would repeal a number of complex features of the current tax code.

![]() Still in the race, Delusional Ohio Governor John Kasich babbles on: “We’re going to have a 10% tithe, and just fix everything with waste, fraud, and abuse? Folks, we’ve got to wake up! These plans would put us trillions of dollars in debt. I actually have a plan. Why don’t we just give a chicken in every pot while we’re coming up with these fantasy tax gains? You have to deal with entitlements. You have to control discretionary spending. I went into Ohio where we had an $8 billion hole, and now we have a $2 billion surplus. We are up 347,000 jobs. In Washington, I fought to get the budget balanced. I was the architect. We cut taxes, and we have a $5 trillion projected surplus when I left.”

Still in the race, Delusional Ohio Governor John Kasich babbles on: “We’re going to have a 10% tithe, and just fix everything with waste, fraud, and abuse? Folks, we’ve got to wake up! These plans would put us trillions of dollars in debt. I actually have a plan. Why don’t we just give a chicken in every pot while we’re coming up with these fantasy tax gains? You have to deal with entitlements. You have to control discretionary spending. I went into Ohio where we had an $8 billion hole, and now we have a $2 billion surplus. We are up 347,000 jobs. In Washington, I fought to get the budget balanced. I was the architect. We cut taxes, and we have a $5 trillion projected surplus when I left.”

But regardless of who’s elected in 213 more days, Beloved Whistleblower Publisher Charles Foster Kane now once again offers his three common-sense suggestions to fix our whole tax-and-spending mess:

![]()

No withholding. No phony refunds. If folks had to write really big checks on TAX DAY, they’d actually know how much they’re paying.

No withholding. No phony refunds. If folks had to write really big checks on TAX DAY, they’d actually know how much they’re paying.

![]() Until we have a simple flat tax without all that paperwork, over-paid Congressmen should be forced to fill out every one of their constituents’ tax forms for free.

Until we have a simple flat tax without all that paperwork, over-paid Congressmen should be forced to fill out every one of their constituents’ tax forms for free.