WEDNESDAY, APRIL 6, 201

The First 114 Days Are the Hardest

YESTERDAY AT THE CONSERVATIVE AGENDA, Political Insiders were asking Beloved Whistleblower Publisher Charles Foster Kane which was his “Favorite Day” in April. “There are so many to choose from,” Kane explained. “So it would be hard to pick a favorite.” But the day we plan to celebrate this year, and so should even all of those Dumbed-Down, Self-Absorbed, Media-Influenced, Celebrity-Obsessed, Politically-Correct, Uninformed, Short-Attention-Span, Free-Stuff Grabbing, Low-Information Obama Supporters Who Put The Positively Worst President in History In The White House—Twice, and get all of their information from our Obama Supporters in the Press, like the ones on Channel 5, is “Tax Freedom Day.” That’s the date our friends at the Tax Foundation say the average US over-taxed payer has worked long enough to pay all of his federal, state, and local taxes for the year. If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 16 days later on May 10.

YESTERDAY AT THE CONSERVATIVE AGENDA, Political Insiders were asking Beloved Whistleblower Publisher Charles Foster Kane which was his “Favorite Day” in April. “There are so many to choose from,” Kane explained. “So it would be hard to pick a favorite.” But the day we plan to celebrate this year, and so should even all of those Dumbed-Down, Self-Absorbed, Media-Influenced, Celebrity-Obsessed, Politically-Correct, Uninformed, Short-Attention-Span, Free-Stuff Grabbing, Low-Information Obama Supporters Who Put The Positively Worst President in History In The White House—Twice, and get all of their information from our Obama Supporters in the Press, like the ones on Channel 5, is “Tax Freedom Day.” That’s the date our friends at the Tax Foundation say the average US over-taxed payer has worked long enough to pay all of his federal, state, and local taxes for the year. If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 16 days later on May 10.

![]()

This year, Tax Freedom Day falls on April 24, or 114 days into the year (excluding Leap Day).

This year, Tax Freedom Day falls on April 24, or 114 days into the year (excluding Leap Day).

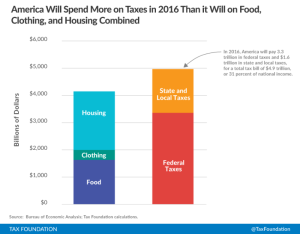

![]() Americans will pay $3.3 trillion in federal taxes and $1.6 trillion in state and local taxes, for a total bill of almost $5.0 trillion, or 31 percent of the nation’s income.

Americans will pay $3.3 trillion in federal taxes and $1.6 trillion in state and local taxes, for a total bill of almost $5.0 trillion, or 31 percent of the nation’s income.

![]() Tax Freedom Day is one day earlier than last year, due to slightly lower federal tax collections as a proportion of the economy.

Tax Freedom Day is one day earlier than last year, due to slightly lower federal tax collections as a proportion of the economy.

![]() Americans will collectively spend more on taxes in 2016 than they will on food, clothing, and housing combined.

Americans will collectively spend more on taxes in 2016 than they will on food, clothing, and housing combined.

![]() If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 16 days later, on May 10.

If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 16 days later, on May 10.

![]() Tax Freedom Day is a significant date for taxpayers and lawmakers because it represents how long Americans as a whole have to work in order to pay the nation’s tax burden.

Tax Freedom Day is a significant date for taxpayers and lawmakers because it represents how long Americans as a whole have to work in order to pay the nation’s tax burden.

![]() Bluegrass Bureau Chief Ken CamBoo says Tax Freedom Day will arrive Saturday on April 11 (ranked #8 latest nationally) because as everybody knows, your state and local taxes are lower in Kentucky. In Columbus, Buckeye Bureau Chief Gerry Manders says Ohio over-taxed payers will work until April 19 (ranked #26 latest nationally) to pay their total tax bills. And Indiana Bureau Chief Hoosier Daddy says Religious Fanatics will be working until April 18 (ranked #24 latest nationally) to pay all their taxes, which includes some fabulous fees on all those new gay wedding cakes.

Bluegrass Bureau Chief Ken CamBoo says Tax Freedom Day will arrive Saturday on April 11 (ranked #8 latest nationally) because as everybody knows, your state and local taxes are lower in Kentucky. In Columbus, Buckeye Bureau Chief Gerry Manders says Ohio over-taxed payers will work until April 19 (ranked #26 latest nationally) to pay their total tax bills. And Indiana Bureau Chief Hoosier Daddy says Religious Fanatics will be working until April 18 (ranked #24 latest nationally) to pay all their taxes, which includes some fabulous fees on all those new gay wedding cakes.

![]() Meanwhile, our friends at the IRS tell us, the April 18 deadline for filing your federal taxes is for real, it’s not just one of those phony baloney ObamaCare deadlines we’re all getting to know and love these days.

Meanwhile, our friends at the IRS tell us, the April 18 deadline for filing your federal taxes is for real, it’s not just one of those phony baloney ObamaCare deadlines we’re all getting to know and love these days.