SUNDAY, APRIL 8, 2018

Last Year, The First 113 Days Were the Hardest

YESTERDAY AT THE CONSERVATIVE AGENDA, a TV interviewer asked Beloved Whistleblower Publisher Charles Foster Kane why “Tax Freedom Day” is so important.

YESTERDAY AT THE CONSERVATIVE AGENDA, a TV interviewer asked Beloved Whistleblower Publisher Charles Foster Kane why “Tax Freedom Day” is so important.

“Tax Freedom Day?” Kane exclaimed. “That’s when all of us over-taxed payers will have earned enough money to cover our federal, state, and local taxes for the entire year.”

“The Blower is still waiting to find out the exact date of Tax Freedom Day in 2018,” Kane admitted, “and as soon as we hear, you can be sure we’ll let all of our Persons of Consequence know.”

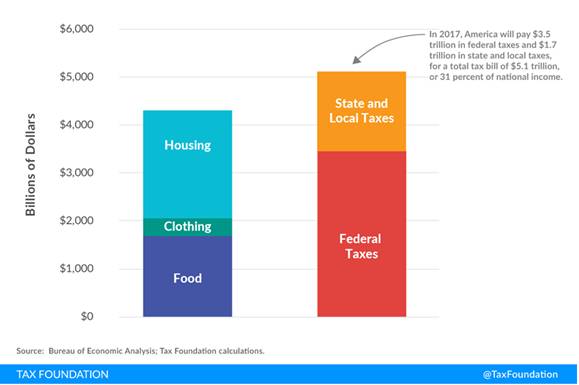

Maybe that’s because last year, Americans paid $3.5 trillion in federal taxes and $1.6 trillion in state and local taxes, for a total tax bill of $5.1 trillion, or 31% of national income.

And thanks to our Republican-Controlled Congress, Americans worked the longest—46 days—to pay federal, state, and local individual income taxes. Payroll taxes took 26 days to pay, followed by sales and excise taxes (15 days), corporate income taxes (10 days), and property taxes (10 days). The remaining six days were spent paying estate and inheritance taxes, customs duties, and other taxes.

And thanks to our Republican-Controlled Congress, Americans worked the longest—46 days—to pay federal, state, and local individual income taxes. Payroll taxes took 26 days to pay, followed by sales and excise taxes (15 days), corporate income taxes (10 days), and property taxes (10 days). The remaining six days were spent paying estate and inheritance taxes, customs duties, and other taxes.

“And if that’s not depressing enough,” Kane added, “According to our friends at the Tax Foundation, Americans spent more on taxes in 2017 than they did on Food, Clothing, and Housing COMBINED. Imagine how bad it would be with our Dishonest DemocRATS is charge.”

![]() Meanwhile, our friends at the IRS tell us, the April 17 deadline for filing your federal taxes is for real. No kidding!

Meanwhile, our friends at the IRS tell us, the April 17 deadline for filing your federal taxes is for real. No kidding!